iSPECIAL MOBILITY ECOSYSTEM

ASSET BACKED SECURITY

UGANDA: CAPITAL MARKETS (ASSET BACKED SECURITIES) REGULATIONS, 2012

"An asset backed security (ABS)

is a security whose income payments and hence value are derived from

and collateralized (or "backed") by a specified pool of underlying

assets."

"The

pool of assets which is typically a group of small and illiquid assets

which are unable to be sold individually. Pooling the assets into

financial instruments allows them to be sold to general investors, a

process called securitization, and allows the risk of investing in the

underlying assets to be diversified because each security will represent

a fraction of the total value of the diverse pool of underlying assets.

The pools of underlying assets can include common payments from credit

cards, auto loans, and mortgage loans, to esoteric cash flows from

aircraft leases, royalty payments, or movie revenues."

"Often

a separate institution, called a special purpose vehicle, is created to

handle the securitization of asset backed securities. The special

purpose vehicle, which creates and sells the securities, uses the

proceeds of the sales to pay back the bank that created, or originated,

the underlying assets. The special purpose vehicle is responsible for

"bundling" the underlying assets into a specified pool that will fit the

risk preferences and other needs of investors who might want to buy the

securities, for managing credit risk – often by transferring it to an

insurance company after paying a premium – and for distributing payments

from the securities. As long as the credit risk of the underlying asset

is transferred to another institution, the originating bank removes the

value of the underlying assets from its balance sheet and receives cash

in return as the asset backed securities are sold, a transaction which

can improve its credit rating and reduce the amount of capital that it

needs. In this case, a credit rating of the asset backed securities

would be based only on the assets and liabilities of the special purpose

vehicle, and this rating could be higher than if the originating bank

issued the securities because the risk of the asset backed securities

would no longer be associated with other risks that the originating bank

might bear. A higher credit rating could allow the special purpose

vehicle and, by extension, the originating institution to pay a lower

interest rate (and hence, charge a higher price) on the asset-backed

securities than if the originating institution borrowed funds or issued

bonds."

■ Capital Markets Regulatory Framework – Quest for Asset Backed Security (ABS) Letter Received on 22nd April 2014

■ Provisional Prospectus Framework – Cover Sheet

■ Transaction Structure Diagram

■ Source of Funds Diagram

■ Priority of Payments Diagram

■ Transaction Parties and Documents Diagram

DOMESTIC REVENUE MOBILIZATION STRATEGY (DRMS) – UGANDA REVENUE AUTHORITY (URA)

The

core objective of the DRMS is to improve revenue collection and lift

Uganda's Tax-to-GDP Ratio to somewhere between 18-20% within five years

of its implementation.The strategy targets to change the way revenue is

raised by targeting the following:

1)

Lifting the capacities of the revenue administration entities to ensure

that revenue is raised in an economically efficient way that reduces

the compliance burden for individuals and businesses;

2)

Enhancing transparency and accountability in the tax solution, make it

harder for the few who would subvert our society to engage in dishonesty

and fraud;

3)

Enhancing taxpayer service delivery, deepening taxpayer education and

access to information to ensure that we are all on one path together.

The

above three areas drive the strategic direction of Uganda Revenue

Authority (URA). The DRMS further sets the pace for URA's Operations by

focusing on key areas to tackle weaknesses across the entire compliance

continuum which include the following: Accuracy of the Tax Register,

timely and accurate filing, timely processing of refunds, improvement of

the effectiveness of Non-Tax Revenues and above all Data Management and

Optimization.

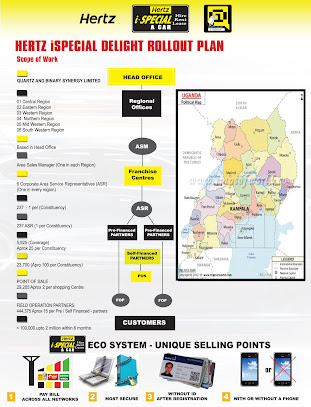

TREASURE THE PEARL, RIDE SPECIAL MOBILITY: UGANDAN TRUST FUND MOOTS AN INTEGRATED MOBILITY PLATFORM FOR AFRICA AND BEYOND

■ Based on our Recognition of the Uganda Revenue Authority (URA)

aspirations as enshrined in the Domestic Revenue Mobilization Strategy

(DRMS), We diligently propose to deploy the DALIFAiSPECIAL INTEGRATED

MOBILITY PLATFORM to enable the Taxpayer transition from the Disruptions

foisted upon the Global Economy by the COVID-19 Pandemic.

■

The proposed platform shall facilitate Taxpayer Conservation of Cash;

Tax Wise financing of the required motor vehicles to conduct

Business/Private Operations; Concentration of the available limited

funds towards execution of Core Revenue/Income Generation Activities;

Steering clear from the Risk of Obsolescence arising from Outright

Private/Public Vehicle Ownership, And the attendant lack of In-Usage

and/or Post-Usage ACRISS / DISPOSAL (e.g, the PPDA statutory constraints) Flexibility.

Premised

on the above scenarios, Please find Shared the highlights of our

Proposed DALIFAiSPECIAL Mobility Ecosystem – Salient Execution Mechanics

that seek to champion the Pearl of Africa aspirations in the wake of

the "Visit Uganda, Invest in Uganda" ( Destination Uganda ) campaign

dubbed " EXPLORE UGANDA, THE PEARL OF AFRICA" that was launched on 21st

January 2022 at Kololo Ceremonial Grounds by His Excellency, the

President of the Republic of Uganda, Yoweri Kaguta Tibuhaburwa Museveni.